Related Stories

VEGAS INC Coverage

The nation’s largest casino company has embarked on its most ambitious foray beyond the glittering world of gambling — by partnering with retail giants to get the attention of millions of shoppers for whom gambling, and even Las Vegas, might be an afterthought.

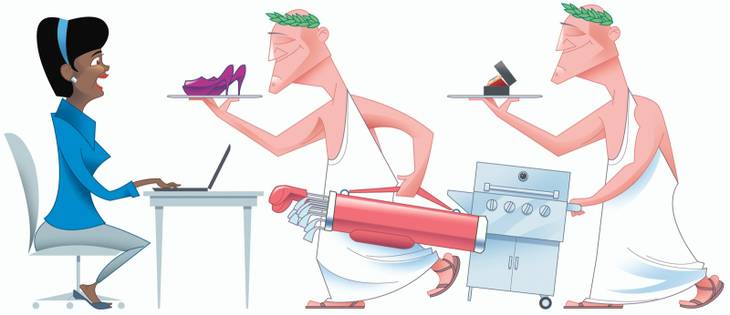

Caesars Entertainment’s Total Rewards Marketplace, introduced last month, allows shoppers at more than 350 online retailers to earn rewards points that can be redeemed for free hotel rooms, meals, shows and many other casino perks typically reserved for big gamblers.

Consumers would earn their Caesars points when they enter the website of a participating retailer through a Total Rewards portal. Once there, buyers would accrue Caesars credits for buying, for instance, a gas grill from BestBuy.com, patio furniture from Wal-Mart.com, outdoor lights from Lowes.com and a set of tumblers from Target.com. The arrangement will enable Caesars to advertise its name to hordes of online shoppers.

“This is a seminal moment for us, bringing Total Rewards outside the confines of traditional gaming,” said Joshua Kanter, the company’s vice president of Total Rewards.

Industry consultants call the move a no-brainer for Caesars and other casino companies seeking to add value to gambling-centric rewards programs. Whether it will make money for Caesars remains to be seen, and will likely depend on what the company is able to do with the database of online shoppers using the network, they said.

“They appear to be prospecting for new customers in (nontraditional) places,” said Dennis Conrad, president of Raving Consulting Co. in Reno. Some major online retailers skew younger than the traditional casino customer, which could be a boon for casinos with a graying database, he said.

The partnership may give the company an edge with current customers by giving them more reasons to visit a Caesars-owned property so they can redeem points earned online, he said.

Jeff Voyles, a casino management professor at UNLV and industry consultant, said it makes sense for Caesars to expand its gambling database to retailers its customers patronize. Caesars may get little financial benefit unless it can use the database to target mailings to specific consumers based on where and how they spend money, Voyles said.

That could be tricky for casinos because in return for offering rewards to shoppers, retailers would want marketing access to casino customers — people who are notoriously private about their spending habits, he said.

“If you buy a pair of jeans at Kohl’s, you don’t mind if Caesars knows about it,” Voyles said. “If you lose $100,000 gambling at Caesars, you don’t want Kohl’s sending you an ad for jeans.”

Extending Total Rewards benefits to Kohl’s customers is probably of little value to Caesars unless it knows the customer buys jeans and can market to him by mailing offers to him, Voyles said.

Kanter did not elaborate on the benefits of the shopping database other than to say the arrangement will give Caesars more insight into customers’ preferences and habits. Retailers also will offer special promotions and discounts to Total Rewards members — a database of more than 40 million people.

The program is the latest in a series of marketing advances that have earned Caesars a reputation outside the casino industry as a technology pioneer.

Caesars, then called Harrah’s Entertainment, was the first casino company to develop a gambler rewards program similar to those created by airlines and credit cards. Its 14-year-old Total Rewards program is involved in a major expansion initiated in 2008 to reward customers for spending on its attractions, such as dining and hotel rooms.

The latest expansion is experiencing some growing pains across Caesars’ nationwide network of 40 casinos. Many venues, including those not owned by the company, don’t have the technology, such as Total Rewards card swipers, to credit rewards points.

Even without the swipers, employees are supposed to record rewards information manually or direct customers to Total Rewards centers to be credited for purchases. In reality, many transactions probably fall through the cracks because big casinos have so many different outlets under one roof, while employees and customers may not be familiar with all of the program’s benefits, said Katrina Lane, Caesars’ chief technology officer.

Even customers dropping big bucks in nightclubs operated by third parties, like Pure at Caesars Palace, can earn Total Rewards points for ordering vodka tonics and mojitos — so long as they present a card to a server or take their drink receipt to a Total Rewards center.

Caesars is working with older technology systems than more recent entrants on the Strip, such as Wynn Resorts and Cosmopolitan. Efforts to market the new Total Rewards benefits were cut short by the recession and have only recently gathered steam, executives said.

“We certainly can’t say we have the latest or greatest system,” Lane said. “What we can say is we have an integrated system. Our breadth is bigger, and we’ve been doing this longer than anyone else.”

Kanter is less concerned with gaps in technology than perception: Many customers are unaware of the card’s nongambling benefits for routine purchases that would be part of a typical casino trip.

Nightclubbers are among the types of Las Vegas customers who may not be aware of those benefits, Kanter said.

The company is training employees to discuss the newer benefits, and will launch a contest next month encouraging customers to earn points in multiple ways such as booking hotel rooms and buying gift shop trinkets.

The Total Rewards expansion was a reaction to an obvious trend.

Gambling accounted for only 39 percent of revenue generated on the Strip last year, down from 46 percent a decade ago, state figures show.

With casino or slot machine gambling in 38 states and lavish, Las Vegas-style resorts spreading throughout Asia, Las Vegas’ dominance over the gambling experience is slipping. Only 9 percent of Las Vegas visitors came here primarily to gamble, according to a Las Vegas Convention and Visitors Authority annual survey.

Most of Caesars’ rewards credits go to gamblers — a reflection of a company that generates the biggest chunk of its profits from slot machines. In the first quarter, 76 percent of its net revenue came from gambling, down from 80 percent a year ago. Overall revenue was down as gamblers reduced casino trips and gambling budgets in the downturn.

Caesars is further along in the nongambling rewards process than its chief Las Vegas competitor, MGM Resorts International, which hopes to reward customers for nongambling purchases by year-end through its M Life loyalty program.

Even Caesars has not achieved the industry’s eventual goal of customizing nongambling offers to customer preferences — an art Caesars and some others have mastered on the casino side by tailoring offers based on where and how gamblers spend money.

The company needs more data on where customers are spending money outside the casino before it can begin to tailor such offers, Lane said.

“They have all the usefulness of this expanded program. But it’s not personalized yet,” she said.