Sun coverage

It’s a mystery why enrollment has taken a plunge this year at the College of Southern Nevada, but CSN administrators suspect the recession’s fingerprints are on it.

With the economic slump now in its third year in Nevada, they say, some would-be students may have simply given up.

“When the economy goes down, education goes up. When the recession hit, our numbers shot up. I think part of it now is just fatigue,” said Darren Divine, vice president of academic affairs at CSN.

But that’s a shame, administrators say, because the college’s 11.89 percent enrollment drop is happening at a time when some employers — who work with the institution to develop curriculum to train workers for positions in their companies — are hiring.

That was confirmed Nov. 21 when the state Department of Employment, Training and Rehabilitation (DETR) said that even with unemployment running at 13.4 percent in Nevada in October, employment had grown statewide by 11,700 jobs — or 1 percent — in the past year.

So where’s the growth happening? And what sectors are still struggling? To learn about prospects in various industries, VEGAS INC spoke recently with Divine and two other experts at CSN — Dennis Soukup, chairman of the Department of Applied Technologies, and Rebecca Metty-Burns, executive director of the CSN Division of Workforce and Economic Development.

CSN is in some ways a barometer of local business activity. It’s in touch with employers about their hiring and retraining needs, and it receives feedback from students about who’s hiring and which companies are offering tuition reimbursement as an incentive.

The bottom line, according to the administrators, is that employment prospects vary dramatically by industry.

But overall, the sentiment at CSN is in line with that of economists at DETR, who expect modest growth for the state in 2012.

•••

HVAC

Soukup sees a brighter future for technicians in heating, ventilation, air conditioning and refrigeration (food service coolers) for a couple of reasons.

There’s not much of a surplus of HVAC technicians locally, he said, because many left town when the economic boom ended in 2007 and 2008, and many of the remaining technicians are nearing retirement age.

“There were so many tracts and apartments and developments going in that if you showed up with a truck and some duct tape, you were an installer. When that boom stopped, the installers left,” Soukup said. “What stayed here were the companies with hi-tech, sustainable service technicians. You and I didn’t leave. We went from our air-conditioned car to our air-conditioned grocery store back to our air-conditioned house. And if we didn’t have that, we would choose not to live here.

“So those service techs and those companies are still in place. They might have had to ramp down a little bit because they lost the construction side of their business. But they kept and held their service abilities.”

Soukup said he expected the field to create 300 to 400 local jobs in the next few years.

In HVAC, professional education is important for employers, Soukup said. Technicians can start at $22 per hour and with several years of experience make $30 to $40 per hour.

“With these technologies, these employers are being more demanding and saying ‘I want to interview your degree graduates — not your certificate graduates,’ ” he said. “They’re appreciating that they’re leaving here with those communication, reading, math and customer service skills. You’ve got to talk to the Emeril Lagasses and the Jean-Philippes at Bellagio, and you don’t go in there as just some stumbling contractor. You’d better have some skills when you show up and meet those individuals.”

•••

ADVANCED TECHNOLOGIES

Soukup says CSN regularly places graduates with specialized skills with employers ranging from defense contractors to Las Vegas Strip casino show producers to airports needing people who can work in flight operations.

“A sleeper that’s up and coming is electronic engineering and mechanical technology,” he said. “Electronic engineering is not just about electronics and robotics, it’s about networking systems and telecommunications.”

He said CSN is training students for positions that may open at JT3, the company providing engineering and technical support for Air Force warplane test and training ranges around the country — including the Nevada Test and Training Range operated by Nellis Air Force Base.

“We are training the next generation of electronic technicians with high-security backgrounds,” Soukup said. “On the mechanical technology side, with all that it does with statistics and fluids and hydraulics, we’re developing the backstage technician for Cirque du Soleil. They have to have hydraulics and welding and HVAC.

“I went backstage and was mesmerized by what the mechanical techs do to make sure those shows are what they are.”

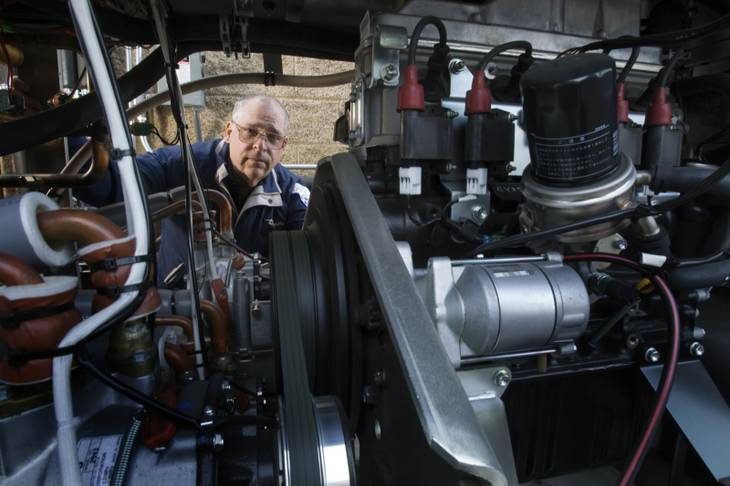

CSN is also on the ground floor of training HVAC technicians to install and maintain technology in which natural gas is used to power air-conditioning and heating units for buildings and large custom homes.

Electric motors traditionally have been used to drive air-conditioning compressors, which are the largest users of power in AC systems. The new technology uses automotive engines running on cheap natural gas to drive the compressors. In the heating mode, waste heat from the engine exhaust and cooling systems is used to heat the buildings.

The new systems offer greater energy efficiency than current mainstream technology, and are starting to be adopted by businesses. Although the advanced systems are currently best suited for new construction or retrofitting commercial buildings, Soukup said development is under way to bring the technology to residential customers.

“This is a very lucrative, high-technology field that’s going to require some training,” Soukup said.

•••

GAMING, HEALTH CARE AND EDUCATION

With about 811,000 jobs in the Las Vegas area, the largest employer locally by far is the gaming and hospitality sector. It accounts for about 33 percent of total employment.

Health care and education, accounting for a combined 9 percent of the jobs locally, include the region’s largest single employer. That’s the Clark County School District, with some 33,000 positions.

Gaming, health care and education are expected to remain the most stable employers in the next few years, Divine said.

“Gaming has been holding pretty steady. It’s tough to say if it’s increasing. It’s sort of a chess match,” he said. “You get Station Casinos saying it’s hired 1,000 people. They had laid off that many. The Sahara closed. It’s this giant churning.

“Health care has been strong, and moving into the foreseeable future that’s going to increase as the population ages.”

New regulations for health care providers have boosted the need for education. For instance, dialysis technicians now have to be certified, he said.

•••

CONSTRUCTION

Construction has been among the hardest-hit industries in Nevada with the recession, but CSN has kept its building-related programs going as it waits for an upturn and to meet the demand for training workers in new fields.

“One thing that came up a lot as the recession kept going and deepening was you saw the push for green jobs,” Divine said. “There are jobs out there, but we need to educate people that with a lot of those jobs it’s not a completely new field.

“With photovoltaic, it’s a field that’s already there, we just need to add an emphasis to it. To meet the current and projected need we’re looking at electricians. So we’ll add to their training and get them re-employed again.”

Despite news generated by potential solar arrays planned in Southern Nevada and possible construction of one or more photovoltaic panel manufacturing plants, Divine sees the industry adding at most a few hundred jobs in the next few years.

That’s partly because once a solar power generating array is built, it doesn’t require many people for operations and maintenance.

He said the people who build solar array fields are classic ironworkers, glaziers and electricians – positions for which there are plenty of available workers.

•••

AUTOMOTIVE AND HORTICULTURE

While prospects in some sectors are improving, not every industry is showing strong signs of a comeback.

Divine said demand for auto technicians is soft, for example.

“Three years ago, the bottom dropped out when the manufacturers all went through an upheaval,” he said. “You saw so many dealerships close all at the same time. So many people flooded the market, the call for new trainees hasn’t been that high.”

Landscaping, golf course management and related horticultural businesses also were hit hard by the slowdown in development and the financial problems of some golf courses. Job growth in the sector has yet to rebound.

“It is slow, because there is nowhere for these folks to go,” Soukup said. “If you’re not building developments, you’re not getting your design person out there locating the shrubs and the trees. That’ll be the last to catch up to the train when it starts to move again.”

•••

ANY TAKERS?

Despite the employment opportunities here and there identified by the CSN administrators, the college is dealing with setbacks brought on by the recession. One is the enrollment drop, which administrators say was unexpected.

The student count is 38,492 this year, down 11.89 percent from last year, and administrators have been talking a lot about the reasons.

One, they said, is that would-be students were inundated with news earlier in the year about potentially devastating budget cuts to higher education in Nevada in the 20 to 30 percent range along with talk about closures of campuses and higher tuition and fees.

Funding cuts did hit CSN, but were not as severe as had been threatened. The cuts amount to about 15.5 percent year to year, or more than $13 million, which the college is dealing with by not filling jobs through attrition, selective program cuts and potential hikes in student fees.

“People were thinking that now’s not the time to enter when the program may not be there or the campus may not be there. We didn’t give a lot of warm fuzzy feelings to people wanting to go back and get some classes,’’ Divine said.