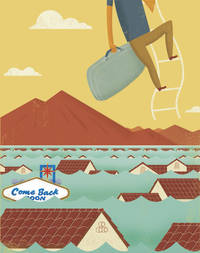

Despite improvements in the housing market, Las Vegas remains well underwater.

Some 48.4 percent of valley homeowners with mortgages were underwater — meaning their debt outweighed their home’s value — in the quarter ending June 30, according to a new report from housing data firm Zillow.

And while that’s down from almost 70 percent a year earlier, Las Vegas’ rate of underwater borrowers remains highest among the 30 metro areas covered in Zillow’s report and more than double the national rate, 23.8 percent.

Las Vegas’ rate is expected to fall to 41.3 percent by the second quarter of 2014, lifting at least 23,600 homeowners out from negative equity, Zillow said. But the rate would still be highest in the country and almost twice the forecasted national rate of 20.9 percent.

Nevertheless, the rate is sliding as home values climb.

The valley’s median home value was $151,600 in July, up 31 percent from a year earlier, according to Zillow.

Las Vegas’ year-to-year growth rate was second-fastest among the 30 markets tracked in the report. Sacramento was first at 33 percent.

Nationally, home values rose 6 percent over the past year, to $161,600.

“Widespread rising home values during the past year have helped chip away at negative equity nationwide, helping many homeowners who were only modestly underwater to come up for air,” Zillow chief economist Stan Humphries said in the report. “For those homeowners who are deeply underwater, though, there is still a long row to hoe.”