For more

Cass Via drove around the Las Vegas Valley for months in his red Ford F-350 pickup truck looking for a house, armed with listings and dropping in on construction sites.

The 47-year-old repair guy is from Colorado and likes open space, but there were two problems with the newly built homes he saw here: their hefty price tags, and for those he could afford, they stood a few feet from the homes next door.

He instead made an offer for a one-story, three-bedroom house in North Las Vegas that was built in the late 1980s.

Via isn’t the only one passing on new homes today. Sales have plunged this year in Las Vegas as would-be buyers, saddled with credit woes, flat wages and sticker shock, can’t pay the high listing prices.

The slowdown is denting Las Vegas’ fragile recovery and marks a sharp reversal from last year, when new-home sales and prices skyrocketed — a big rebound that now seems to be backfiring.

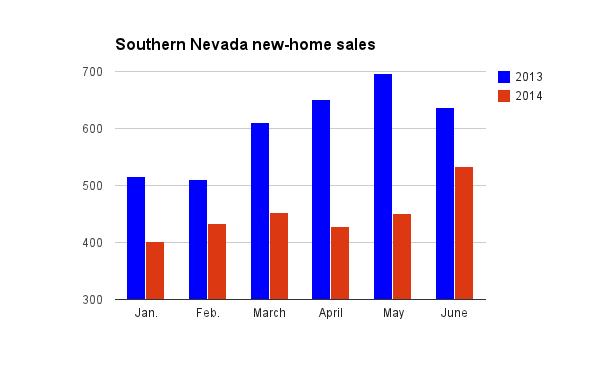

Southern Nevada builders sold about 2,700 new homes in the first half of 2014, down 25 percent from the same period last year, according to Las Vegas-based Home Builders Research. Nationally, new-home sales slipped just 4 percent in that time, federal data show.

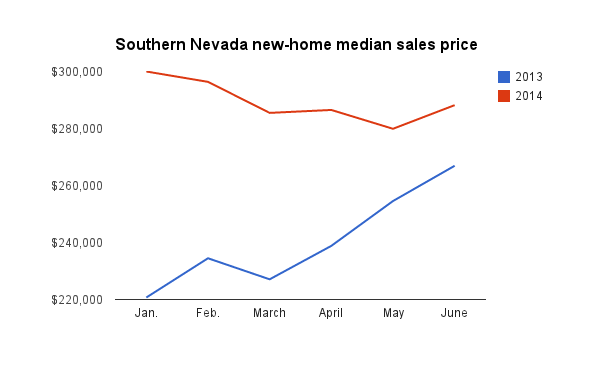

Prices are up from a year ago but sliding. The median sales price in Las Vegas in June was around $288,000, up 8 percent from a year earlier but down 4 percent since January.

At bottom, local builders sold just 3,900 new homes in 2011, but they bounced back with 5,500 sales in 2012 and 7,300 last year. In December, new homes sold for a median $298,600, up 37 percent from a year earlier, the largest year-to-year percentage jump in nine years.

Builders were so confident that the market had healed that they’ve tried selling for big prices with little to no incentives, said Luxe International Realty owner Melissa Zimbelman.

Now, at least some developers are slashing prices and offering buyers more perks, such as free upgrades.

“Prices were going up by the week,” Zimbelman said. “Builders had to back off.”

To boost sales, builders also are making more project pitches to real estate agents — hoping they steer clients to construction sites — and pumping up agents’ sales commissions from 2 to 3 percent of the purchase price to 5 to 8 percent, RE/MAX Extreme agent Tim Kiernan said.

“They’re hurting right now,” he said.

Buyers started pulling back in the second half of 2013 amid rising prices and borrowing costs. The average interest rate for a 30-year mortgage rose last year from 3.41 percent in January to 4.46 percent in December, according to mortgage-finance company Freddie Mac.

Sales volume rose through last summer, reaching 763 deals in August but slid to 544 in December.

“Everything just got sluggish,” said Klif Andrews, Las Vegas division president for Pardee Homes.

Nevadans also have some of the worst personal finances in the country, making it impossible for many people to get a mortgage anytime soon, especially for an expensive, newly built home.

Banks typically won’t lend to someone if they had a bankruptcy in the past two to five years or lost their home to foreclosure within one to seven years. After the housing bubble burst, Las Vegas was ground zero for foreclosures and underwater borrowers, problems that have eased but remain widespread.

"There’s a lot of pent-up demand out there,” said Rob McGibney, Las Vegas division president for KB Home. "They’re just waiting for these time limits to expire.”

Even if they qualify for a loan, affording the down payment is sometimes impossible. Some 56 percent of households statewide are in a “persistent state of financial insecurity” with little or no savings, the nonprofit Corporation for Enterprise Development has reported. That’s the second-highest rate of financial insecurity in the country, behind Mississippi.

What’s more, federal housing officials in January reduced the pool of potential buyers by drastically lowering the limit on mortgages they’d guarantee in Las Vegas, to $287,500 from $400,000 for the purchase of a single-family house. Citing a national housing rebound and uptick in private lending, officials slashed the Federal Housing Administration-backed loans nationwide. But given how hard Las Vegas was hit by the recession, it seems local residents would be far more dependent on federal backing to obtain a mortgage than people in other cities.

“That took a big chunk of folks out of the market,” said Jeremy Parness, Las Vegas division president for Lennar Corp.

Still, sales totals could rebound in coming months, builders say.

More buyers are under contract for new homes, and reflecting this uptick, developers are pulling more construction permits, Pardee’s Andrews said.

Builders typically don’t start construction on a home until after someone agrees to buy it. Local builders pulled 703 permits in June, up from 450 in January, according to Home Builders Research.

“We’re selling,” Andrews said.